The CA Quarterly Review (Spring 2024)

NEWS & INFORMATION QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMIN FOR Tennessee

- Happy Spring!

-

- Green and Resilient Retrofit Program for Multifamily Housing (GRRP) – Supplemental Notice A

-

To implement certain changes to the Green and Resilient Retrofit Program (GRRP), HUD released Notice 2024-1 Supplemental Notice A which amends HUD Notice 2023-05. The Green and Resilient Retrofit Program (GRRP) was designed with three goals:

1. To reduce energy and water use in HUD-assisted multifamily properties,

2. To make HUD-assisted multifamily properties more resilient to extreme weather events and natural disasters, and

3. To reduce greenhouse gas emissions from HUD-assisted multifamily properties, both directly and by using materials with less Embodied Carbon.The GRRP Notice describes program requirements, processes, and monitoring after participant selection. Information about eligibility, application and selection procedures is contained in various Notice of Funding Opportunity (NOFO) publications.

Supplemental Notice A supplements and amends Housing 2023-05 in the following respects:

- Disbursement of GRRP Funds. Amends the disbursement requirements for the Elements, Leading Edge, and Comprehensive awards by revising the process for submitting draw requests, increasing the maximum amount of award funds that may be disbursed during the construction period, clarifying a condition for when remaining funds may be disbursed, and removing the requirement for an Escrow Deposit Agreement for the disbursement of Comprehensive Award funds.

- Surplus Cash Loan Terms. Provides updates to the terms for Surplus Cash Loans by clarifying when payments begin, allowing for the payment of deferred developer fees prior to calculating the Surplus Cash for the first ten years of payments, and extending the term of any Surplus Cash Loan from 15 years to up to 30 years.

- Renewable Energy Credits. Adds guidance about the purchase of renewable energy credits by the Owner to achieve a Leading Edge Qualifying Certification. Owners must continue to purchase credits for the greater of the duration required by the Certification or three (3) years.

- Davis-Bacon Wages and Project Labor Agreements. Clarifies when the Davis-Bacon wage rates should be locked in at the issuance of the Leading Edge Commitment (LEC) or Comprehensive Construction Commitment (CCC) and adds guidance for Owners that elect to submit a project labor agreement (PLA).

- Developer Fee Terms. Clarifies limits on the total developer fee.

- Other Technical and Clarifying Changes on the following items:

- Resident Notification after Award

- GRRP Shared Savings Retainer

- Combining GRRP Award with Other Government Funds

- Energy Reduction Goal Methodology

- Elements Closing Package Requirements

For more details on these amended items, please review HUD Notice 2024-1.

-

- Notice H-2024-3: Approval and Processing of Requests to Bifurcate Contracts

-

On 1/31/2024, HUD published a Housing Notice H-2024-3 titled Approval and Processing of Requests to Bifurcate Contracts. Bifurcation is an important asset management and housing preservation tool. The Notice explains the standards and conditions a Project Owner must meet to obtain HUD approval for a Housing Assistance Payments (HAP) contract bifurcation, clarifies owner submission requirements, and describes the processing of approved bifurcation requests. The Notice applies to bifurcation requests submitted to HUD on or after February 1, 2024.

Read the full Notice here.. - HUD Notice 2024-05 Summary: Budget-Based Rent Adjustments for M2M Properties

-

Enacted as part of the Multifamily Assisted Housing Reform and Affordability Act of 1997 (MAHRA), the M2M program was designed to preserve the affordability of low-income multifamily rental properties with loans insured by the Federal Housing Administration (FHA) and to introduce administrative efficiencies in the multifamily FHA-insured Section 8 portfolio. M2M allows HUD to adjust the rents down to market on certain projects that have above-market project-based Section 8 contract rents.

Through the M2M restructuring, if Owners wish, HUD may also restructure debt that is FHA-insured or Secretary-held to ensure that the owner has a first mortgage loan that is supportable at the new rents. Then after restructuring, rent adjustments for M2M properties have historically been limited to the Operating Cost Adjustment Factor (OCAF) pursuant to Section 514(e)(2) of MAHRA.

While the OCAF has been adequate for some properties, annual OCAFs haven’t been enough to cover some property’s expenses. Providing Budget-Based Rent Adjustments (BBRAs) ensures that project income can cover project operating expenses and can support debt service sufficient to perform necessary rehabilitation and recapitalization.

Per HUD Notice 2024-05, the eligibility requirements for submitting a M2M BBRA follows:

1. M2M Property. The Property must have an active M2M Use Agreement and must be subject to a Full Mark-to-Market Renewal Contract, an Interim (Full) Mark-to-Market Renewal Contract, or an Interim (Lite) Mark-to-Market Renewal Contract, all established pursuant to MAHRA.

2. Statutory Eligibility. Project Income is insufficient to operate and maintain the Property and no rehabilitation is currently needed, or the BBRA is necessary to support commercially reasonable financing (including any required debt service coverage and any necessary deposits into a reserve for replacements) for rehabilitation necessary to ensure the long-term sustainability of the Property.

3. Contract Rents. The rent for all units on the HAP Contract at the Property must be less than comparable market rents, as defined by an RCS.

4. FASS Findings. All FASS findings for the property must be resolved to HUD’s satisfaction or subject to a HUD-approved action plan. The action plan must be in current without open notices of delinquency or breach.

5. MOR Status. The property must have been subject to a MOR review within the three (3) years prior to the Initial Submission or after the Initial Submission, unless otherwise approved by HUD. If the condition is not satisfied, an MOR must be requested.

6. Good Standing. At closing, the Owner and Management Agent must be in good standing with HUD defined as: Previous Participation Certification on file in the Active Partners Performance System (APPS), all principals are not debarred, suspended or subject to a Limited Denial of Participation, and any flags in APPS are resolved or any open flags are accepted by HUD. Also, the following must be true: the Management Agent’s portfolio must have acceptable MOR ratings, the Owner must have submitted all required Financial Statements, and the Owner and Property must be in full compliance with Program Obligations and have no defaults.

7. Fair Housing. The Owner must not have any outstanding violations of fair housing laws in connection with any Property owned by the owners, unless otherwise approved by HUD.

HUD will prioritize BBRAs for properties that meet the above criteria by considering two factors:

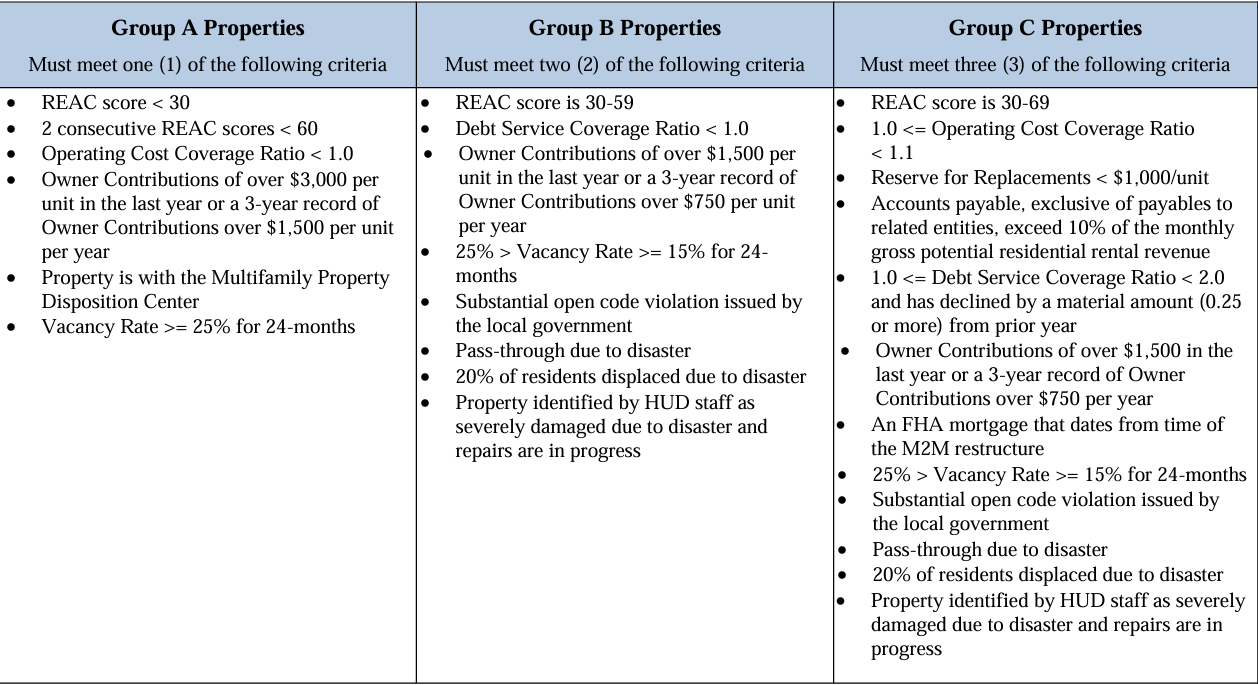

1. The property conditions, which define a property as Group A, B or C. In HUD Notice 2024-05, HUD provided Appendix 1 as a visual representation of what classifies a property as Group A, B and C.

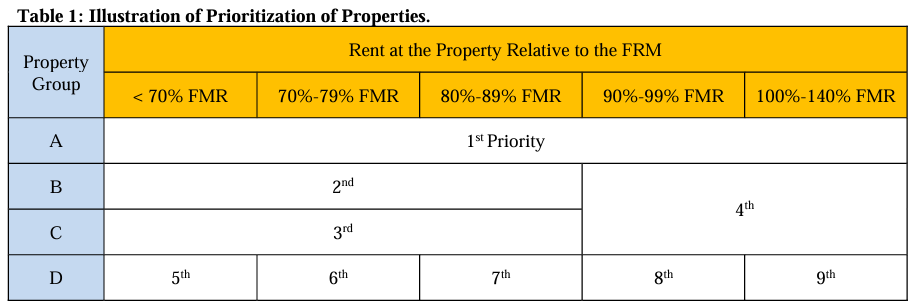

2. The relationship between the property’s current Contract Rent and FMR (Fair Market Rent). In the HUD Notice, HUD provided Table 1 to show how HUD will prioritize BBRA’s as the funding available for BBRAs is limited.

NOTE: Appendix 1 and Table 1 were provided as visual representations of the text to assist in the reader’s comprehension. Where there is a distinction between this appendix and the text, the text shall govern. Also, it is important to note that Group D is prioritized after Groups A, B and C.

Today, only Owners with properties meeting the 1st Priority (Group A) ranking criteria (shown above) are invited to submit an Initial Submission. When the time comes, HUD will invite Groups B, C, and D to submit an Initial Submission. Properties must meet the priority criteria at Initial Submission.

To apply, Owners should apply through the Multifamily Preservation Desk indicating their Priority Group. Then, there will be a two-step process to follow- the Initial Submission and the Final Submission.

NOTE: HUD’s Office of Recapitalization will process the BBRA request, not the PBCA.

At the Initial Submission, here are some items HUD will review and consider (not an all-inclusive list):

- Basic owner and property information

- Statutory eligibility

- MOR, or request for an MOR if one wasn’t conducted in the last 3 years

- Rent/UA Schedule for each unit type, the weighted rent, and weighted FMR

- Owner’s determination of the property’s Group Status

- Certified Owner Statement explaining why the property qualifies for the requested groups status (supporting documentation is not required at this stage, the Owner’s certified statement will suffice)

- Owner’s reasonable estimate of market rent by unit size (it is not recommended to order an RCS at this stage, Owner’s should use information on-hand)

NOTE: 1st Priority (Group A) properties: Submit your Initial Submission by 11:59 PM EST on 3/28/2024 to be deemed as received simultaneously. Initial Submissions received by HUD thereafter will be ordered according to the date and time stamp. Submissions received simultaneously will be ordered by random lottery.

HUD will review the Initial Submission to determine whether the eligibility requirements are met, confirm that the property qualifies as the requested Group Status, and confirm that the property fits the prioritization categories invited to submit a BBRA request at that time. If the property is eligible, and when HUD determines it is likely to have funds available to accommodate the request, HUD will invite the Owner to assemble and deliver the Final Submission.

At the Final Submission, here are some items HUD will review and consider (not an all-inclusive list):

- Owner Narrative

- Organization Chart

- Good Standing Justification

- Capital Needs Assessment, Inclusive of a Green Analysis

- MOR Corrective Action Plan, if applicable

- Development Budget

- Financing Commitments

- Vacancy/Occupancy Report

- Audited Annual Financial Statement (3 Years)

- Budget Worksheet (HUD Form 92547)

- Operating Proforma

- Rent Comparability Study (RCS)

- Statement of Compliance with Fair Housing and Civil Rights

- Resident Notification

- Service Coordinator Budget, HUD Form 91186A, if applicable

- UEI Number

The Office of Recapitalization, in consultation with regional asset management staff, will evaluate the request. Upon completion of Recap’s review, HUD will issue a conditional approval of new rents for the Property. HUD will give authority to use the new rents only after all conditions in the conditional approval have been confirmed by HUD and the effective date of the BBRA has occurred.

If you are a M2M property and are interested in receiving a BBRA, it is strongly encouraged to review the entire HUD Notice 2024-05 for details on the BBRA process and the terms and conditions involved. For more information on how to apply, visit this website.

-

- Navigating Voucher Changes: Recent HOTMA Updates

-

On February 5, 2024, HUD published a revised version of the HOTMA Implementation Notice H 2023–10 with updates to guidance in Sections 102 and 104. Section 102 addresses income reviews, including the frequency of income reviews and revises the definitions of income and assets while Section 104 sets asset limits for both Section 8 Project-Based Rental Assistance and Section 202/8 programs. Changes from the previous version are described in Section 2.1 of the revised Notice, and the changes that directly impact vouchering are outlined below.

Effective Date & Compliance

Although the HOTMA Final rule is effective January 1, 2024, HUD previously extended the deadline for HOTMA implementation to coincide with 203A implementation, and both must be done no later than January 1, 2025. HUD approved this extension, understanding that HOTMA rules do impact the industry significantly and both CAs and OAs need time to fully implement the required changes. Properties are expected to bring their programs into compliance in accordance with the HOTMA Final Rule once software is fully 203A compliant, but no later than January 1, 2025.

OAs should also pay close attention to Section 6.2 of Notice H 2023–10, which explains additional requirements that must be completed prior to and after implementing HOTMA. For example, one requirement in the HUD Notice is that both their TSP (Tenant Selection Plan) and EIV (Enterprise Income Verification) policies and procedures must be updated to reflect HOTMA rules by May 31, 2024.

With that said, based on our interpretation, OAs do not have to take any steps to implement HOTMA until their software has been updated for TRACS version 203A. What this means for now is that all 2025 certifications that OAs start creating in September of this year must be compliant with HOTMA requirements and therefore, both OA and CA software must be 203A compliant by then. Of course, this is assuming that all HUD forms have been approved and 203A Specs have been released by this time. Once 203A Specifications along with the final version of the 203A MAT User Guide are published, and HUD Forms are approved, there is an understanding throughout the industry that we will coordinate an implementation schedule among all stakeholders. This way everyone (CAs, OAs, and Software Vendors) are all on the same page to support a smooth transition.

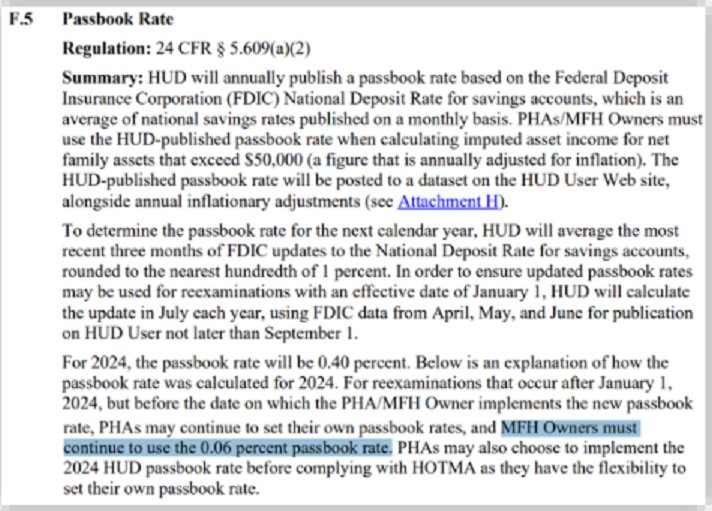

Passbook Rate Change - Not Related to HOTMA

The passbook rate is published annually by HUD and is based on a 3-month average of the National Deposit Rate for savings accounts set by the FDIC (Federal Deposit Insurance Corporation), which are published on a monthly basis. HUD will calculate the passbook rate in July of every year using the FDIC data from April, May, and June. HUD will then publish the new rate sometime in August on the HUD User Website, but no later than September 1st of every year so that OAs can begin using the new rate on all certifications effective January 1st of the following year.

Full certifications must use the appropriate HUD-published passbook rate when calculating imputed asset income for net family assets that exceed $50,000 (a figure that is annually adjusted for inflation). For 2024, the HUD Published Passbook Rate is 0.40%. Normally, the yearly rate change would just be updated in both OA and CA software; however, the issue preventing the industry from updating this synchronously right now is because any statement of change that is included in the HOTMA notice are all subject to HOTMA rules and TRACS version 203A being implemented by the industry. So, while the passbook rate is not directly related to HOTMA, this change is directly related to the asset changes from HOTMA and therefore, HUD has confirmed in the updated notice that “MFH Owners must continue to use the 0.06 percent passbook rate” for now.

U.S. Department of Housing and Urban Development. (2024). Revised HOTMA Implementation Notice H 2023–10. Retrieved from https://www.hud.gov/sites/dfiles/OCHCO/documents/2023-10hsgn.pdf

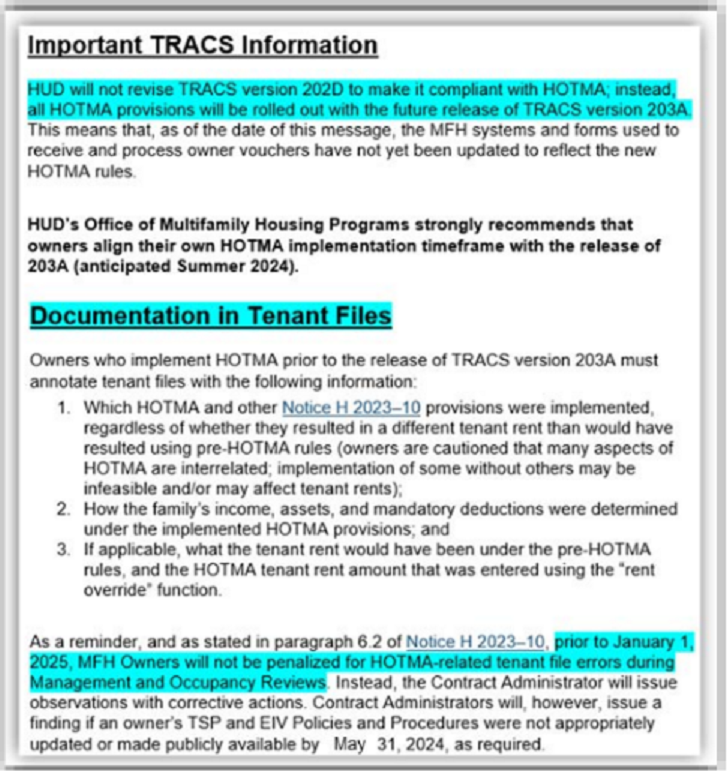

On February 6, 2024, an email notification was also sent out by HUD clarifying that TRACS will not turn on any HOTMA rules until the implementation of TRACS version 203A along with HUD’s recommendation that OAs also align their own HOTMA implementation congruently with 203A.

HUD Multifamily Asset Management, communication, February 6, 2024

With that said, our interpretation is that the OA can choose one of the following options:

1. Refrain from changing it until TRACS 203A version is released and both 203A and HOTMA are fully implemented at the property.

- This method is the path of least resistance and will not cause TRACS to recalculate the certifications or throw any errors.

- HUD has confirmed that TRACS will not be updated with any HOTMA changes until 203A version is implemented.

2. For those who have already updated to the 0.40% passbook rate, revert back to the old passbook 0.06% rate.

- HUD did not explicitly state that OAs must go back and recalculate, or correct certifications submitted using the pre-2024 rate. Therefore, if the rate was changed to 0.40% and TRACS is recalculating the assistance and throwing discrepancies with Action Code 1, the OA can choose to revert back now without creating an additional burden.

- OAs must document the tenant files and make a note that the updated notice was issued on February 6, 2024. Consequently, certifications created between January 1, 2024, and February 6, 2024, may not fully clarify all the details.

- HUD has confirmed that prior to January 1, 2025, MFH Owners will not be penalized for HOTMA-related tenant file errors during Management and Occupancy Reviews. Instead, CAs will issue observations with corrective actions.

3. For those who have already updated to the 0.40% passbook rate, choose to continue using it.

- Keep in mind that selecting this method will result in TRACS recalculating assistance and generating discrepancies with Action Code 1 for all processed certifications.

- Importantly, tenants will not be inactivated in TRACS solely due to this error.

Elderly/Disabled Allowance Change - Related to HOTMA

When calculating rent and assistance payment levels, HUD regulations permit certain allowances or deductions to be excluded from a family’s overall yearly income, provided the family is eligible. This benefits the tenants by calculating their rent portion based on a reduced adjusted annual income. Effective January 1, 2024, HOTMA has increased the deduction for elderly/disabled households from $400 to $525. In the updated HUD Notice, Attachment C, subtopic C.2, HUD clarified that although the elderly/disabled family deduction is effective on January 1, 2024, MFH Owners will apply the new elderly/disabled family deduction to a household’s next interim or annual recertification, whichever comes first, once the OA has uniformly implemented the new $525 elderly/disabled family deduction at the property.

This change is directly related to HOTMA, where HUD has clarified that all HOTMA-related rules must be implemented alongside TRACS version 203A. However, we’ve noticed that some OAs have already begun using the new $525 deduction. Therefore, the following points need to be highlighted for those OAs who choose to implement the requirements outlined in the HOTMA Implementation Notice before the release of TRACS version 203A:

1. Although HUD is allowing MFH Owners some flexibility to implement certain aspects of the HOTMA Notice 203A now, this approach creates additional work and documentation requirements compared to waiting until the industry is fully prepared to handle the updates.

- Given that TRACS will not be updated to be HOTMA compliant, making these changes will cause TRACS to recalculate assistance levels and generate discrepancies with Action Code 1.

- OA’s must employ the Rent Override feature and, in most cases, manually calculate certifications while ensuring accuracy and be confident in determining accurate rent and assistance levels.

2. If OAs are applying some of the new HOTMA and/or 203A rules to 202D certifications, special attention must be paid to Paragraph 6.2 of the HUD Notice H 2023-10. his was also specified in the email received from HUD on February 6, 2024.

HUD Multifamily Asset Management, communication, February 6, 2024

Summary & Key Points

On February 5, 2024, HUD published a revised version of the HOTMA Implementation Notice H 2023–10, which included updates to guidance in Sections 102 and 104. The following day, Multifamily Housing published a message for stakeholders that provided guidance for Owners who choose to implement HOTMA prior to the rollout of TRACS version 203A. The most significant impacts on vouchering were the changes in the Passbook Rate and the Elderly/Disabled Family Deduction.

HUD is currently allowing MFH Owners some flexibility to implement certain aspects of the HOTMA Notice and 203A as they relate to HOTMA. However, this approach creates an additional burden on our OAs due to documentation requirements if HOTMA is implemented prior to industry readiness. This readiness includes updating TRACS to version 203A, updates to the MAT User Guide, approval of HUD forms by OMB, and full updates to both OA and CA software to ensure 203A compliance. Therefore, it is the recommended that all stakeholders wait for any HOTMA and 203A updates until the industry is fully prepared to implement both HOTMA and TRACS version 203A.

As the PBCA, we emphasize that we neither can nor will recommend how an OA should implement HOTMA rules. The OA must independently decide how and when to incorporate aspects of HOTMA. This determination should be clearly outlined in the Tenant Selection Plan (TSP), EIV policies and procedures, and any other relevant controlling documents established by the OA. During this interim period, the PBCA will exercise maximum flexibility, as allowed by HUD, in approving submitted vouchers and certifications.

HOTMA Implementation Resources

- MFH HOTMA Webpage: Housing Opportunity Through Modernization Act | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

- Owner Tenant Selection Plan (TSP) and Enterprise Income Verification (EIV) Discretionary Policies guide published on 10/2/2023 and revised on 2/5/2024: MFH List of Discretionary Policies to Implement HOTMA - Updated 2-1-2024 (hud.gov)

- HOTMA Talking Points and Q&A for Multifamily Programs: HOTMA Talking Points for Multifamily Programs 2-6-2024 (hud.gov)

-

- New HOTMA Implementation Guidance from HUD

-

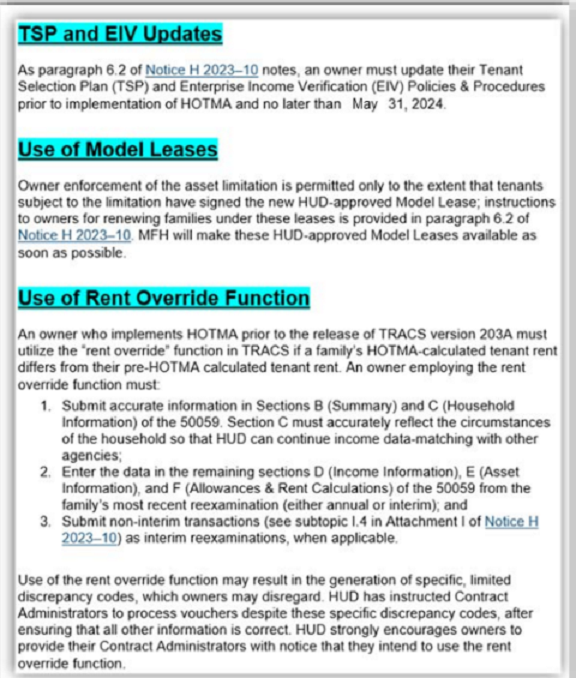

On February 5, 2024, HUD published a revised version of the HOTMA Implementation Notice (Notice H 2023-10). Along with this update, HUD reminds Owners that HOTMA provisions will not be available systematically until the release of TRACS version 203A which is anticipated Summer 2024. HUD’s Office of Multifamily Housing Programs strongly recommends that owners align their own HOTMA implementation timeframe with the release of 203A.

For Owners who begin implementing HOTMA guidelines prior to the release of 203A, HUD notes several important factors to keep in mind:

- Intake forms used to receive and process owner vouchers will not be updated until the TRACS update.

- Enforcement of the asset limitation is permitted only once tenants have signed the new HUD-approved Model Lease which HUD plans to make available as soon as possible.

- The “rent override” function will have to be utilized in TRACS if a family’s HOTMA-calculated tenant rent differs from their pre-HOTMA calculated tenant rent, and the following must be done:

1. Submit accurate information in Sections B (Summary) and C (Household Information) of the 50059. Section C must accurately reflect the circumstances of the household so that HUD can continue income data-matching with other agencies;

2. Enter the data in the remaining sections D (Income Information), E (Asset Information), and F (Allowances & Rent Calculations) of the 50059 from the family’s most recent reexamination (either annual or interim); and

3. Submit non-interim transactions (see subtopic I.4 in Attachment I of Notice H 2023–10) as interim reexaminations, when applicable.

- Tenant Files must be annotated to reflect the following:

1. Which HOTMA and other Notice H 2023–10 provisions were implemented, regardless of whether they resulted in a different tenant rent than would have resulted using pre-HOTMA rules (owners are cautioned that many aspects of HOTMA are interrelated; implementation of some without others may be infeasible and/or may affect tenant rents);

2. How the family’s income, assets, and mandatory deductions were determined under the implemented HOTMA provisions; and

3. If applicable, what the tenant rent would have been under the pre-HOTMA rules, and the HOTMA tenant rent amount that was entered using the “rent override” function.

With the notice, HUD also reminds Owners of the requirement to update their Tenant Selection Plan (TSP) and Enterprise Income Verification (EIV) Policies & Procedures no later than May 31, 2024 (extended from original March 31, 2024 compliance date). HUD also reminds that, prior to January 1, 2025, MFH Owners will not be penalized for HOTMA-related tenant file errors during Management and Occupancy Reviews. Instead, the Contract Administrator will issue observations with corrective actions. Contract Administrators will, however, issue a finding if an owner’s TSP and EIV Policies and Procedures were not appropriately updated or made publicly available by May 31, 2024, as required.

Section 2.1 of the re-released Notice outlines the specific changes from the previous version. HUD has updated Attachment A to address the asset limitation found in Section 104 of HOTMA, and replaced the previous Attachment A that included placeholder language. In addition, HUD has made several technical corrections and added clarifying language throughout the notice, based on feedback from stakeholders and further analysis of the HOTMA Income and Assets Final Rule and related laws and regulations.

Click here to review the list of changes.

-

- NSPIRE’s Extended Compliance Date

-

As we know, the National Standards for the Physical Inspection of Real Estate (NSPIRE) who’s Final Rule was published on May 10, 2023, strengthened HUD's physical condition standards and re-envisioned how HUD-assisted housing was inspected by aligning and consolidating the inspection regulations. Some of the key changes included in NSPIRE Final Rule follows:

- New Self-Inspection Requirement and Report. PHAs and Owners are required to conduct self-inspections of all units at least annually and correct all identified deficiencies. If the property scores under 60, these reports must be provided to HUD. Records related to the self-inspection should be maintained for three years.

- Timeline for Deficiency Correction. HUD clarified the timeline for the correction of health or safety deficiencies. For life-threatening and severe deficiencies, the PHA or Owner must correct the deficiency within 24 hours after the inspection report is received, and upload evidence of that correction within 72 hours to HUD.

- New Affirmative Requirements. HUD developed new “affirmative standards” for all units that participate in HUD’s rental assistance programs. These include basic requirements for habitability – like kitchens and flushable toilets – but also important safety concerns like Ground Fault Circuit Interrupter (GFCI) outlets, a permanent heating source, and safe drinking water.

- Tenant Involvement. HUD will allow tenants to make recommendations regarding units to be inspected. HUD will require that the PHA or Owner correct all identified deficiencies within established timeframes and provide inspection results to residents.

The NSPIRE final rule included amendments to 24 CFR parts 92, 93, 574, 576, and 578 to conform their various inspection requirements to NSPIRE and established an effective date for these amendments of October 1, 2023.

However, NSPIRE’s compliance date per Federal Register Notices FR-6086-N-07 and FR-6086-N-08 for the HOME Investment Partnerships Program (HOME), Housing Trust Fund (HTF), Housing Opportunities for Persons With AIDS (HOPWA), Emergency Solution Grants (ESG), Continuum of Care (COC) programs (“CPD programs”), Housing Choice Voucher (HCV) and Project Based Voucher (PBV) has been extended until October 1, 2024.

Participating jurisdictions and grantees should prepare for the compliance date by updating property standard regulatory citations and requirements in written agreement templates with State recipients, subrecipients, and project owners. However, as HUD has determined that additional time is necessary for some PHAs to fully implement NSPIRE, this extension was implemented to provide PHAs with additional time to train staff, communicate with landlords and for HUD to provide additional technical resources needed for PHAs and agencies to transition to the NSPIRE standards.

To stay abreast with updates to NSPIRE’s implementation, it is highly encouraged to review HUD Housing Notices daily which is where you’ll find these updates the moment they’re available.

- Important Reminder: Having Call Center Flyer Posted for Residents

-

Dear Owners and Management Agents,

As Spring brings rain showers, it can also bring questions and concerns regarding a variety of topics including: rent calculation, maintenance, HUD Handbook 4350.3, and vouchering. As the Contract Administrator for your Section 8 Multi-family Housing properties, the PBCA Call Center is ready to assist. Our team of Customer Relation Specialists serve as a neutral third party to residents, owners, and the public to assist in ensuring HUDs mission of providing Decent, Safe, and Sanitary Housing.

The Call Center needs your help to ensure that all residents are aware and have access to the contact information in order to reach out to our Customer Relation Specialists. Please make sure our Call Center flyer is posted at your properties, so residents and applicants have access to the HUD required resource.

The Call Center flyer is always available at the end of this Newsletter for your convenience.

-

- Get Ready for Spring Cleaning—Records Retention Requirement Reminders

-

As we enter the spring months, now is the perfect time to conduct a thorough spring cleaning of your files. In order to facilitate your ‘out with the old, in with the new’ spring attitude, here are some reminders about record retention requirements.

Applicant File Retention – HUD Handbook 4350.3 Chapter 4, 4-22

Applicant Files must be maintained from the time the application is accepted, through the wait list period and for three years after the applicant is removed from the waist list.

- The current application must be retained as long as applicant is active on the waiting list.

- If the applicant was removed from the waitlist, then the application, supplement to application (HUD 92006), initial rejection notice, applicant reply, copy of the owner’s final response and all documentation supporting the reason for removal must be retained for three years.

- After an applicant moves in to the property the application and supplement to application (HUD 92006) must be maintained in the tenant file for the term of tenancy plus three years.

Resident File Retention – HUD Handbook 4350.3 Chapter 5, 5-23

Resident files (all documentation) must be maintained for the term of tenancy plus three years thereafter.

- Owners must keep the following documentation in the resident file:

- All original, signed HUD 9887s and 9887As;

- A copy of signed consent forms;

- A copy of the EIV Income Report, the HUD 50059 and any other documentation obtained supporting rent and income determinations; and

- Any third party verifications

Retention of EIV Reports – HUD Handbook 4350.3 Chapter 9, 9-14

- The Income Report, Summary Report and the Income Discrepancy Report along with any supporting documentation must be retained in the resident file for the term of tenancy plus three years.

- Any tenant provided documentation to supplement the Social Security Administration or National Database of New Hires data must be retained in the resident file for the term of tenancy plus three years.

- Results of the Existing Tenant Search must be retained with the application:

- If the applicant was not admitted, it must be retained with the application for three years.

- If the applicant was admitted, it must be retained in the resident file for the term of tenancy plus three years.

- The master file containing the New Hires Report, Identity Verification Reports, Multiple Subsidy Report and Deceased Tenant Report must be retained for three years.

Once the retention period has expired for all of the above listed requirements, owners must dispose of the data in a manner that will prevent any unauthorized access to personal information (shred, burn, pulverize, etc.). It is recommended to review the above requirements once a year to ensure unnecessary documentation is being kept and stored on-site.

Many residents may reside at a property for multiple years and this will cause the resident file to become quite large. Owners may choose to move/reduce the files sizes located at the property; however, it is recommended to keep all move-in documentation along with the most recent five years’ worth of recertifications. If file documentation is removed from the property it must be kept in secure storage, the documentation cannot be destroyed. It is recommended to include this policy in an owner/agents written management procedures.

Happy Spring cleaning!

-

- Springtime Reminders

-

Change Batteries

Be proactive this spring and be sure to change the batteries in all smoke detectors and carbon monoxide detectors/alarms to ensure exigent health and safety compliance.

Enjoy the Outdoors

Ensure sidewalks, parking lots, and all outdoor spaces are clean and free of hazards and are ready to be utilized and enjoyed by residents.

Safety First

Spring is a great time to check and service all dryers to ensure vents are clear of lint and change filters for heating/air systems.

General Maintenance

Spring is also a great time for preventative maintenance:

- Check the roof for leaks or broken shingles

- Eradicate excess moisture with dehumidifiers if necessary

- Clean out the gutters and foundation vents

- Replace damages screens, windows and doors

- Clean and repair drainage systems

- Ensure all doors lock properly

- Check to be sure the fire system and fire extinguishers are in good working order

- Check security systems/cameras etc. are in good working order

- Review indoor appliances, electrical systems

Taking care of your property as the seasons change will help to prevent structural damage, save energy and money, and keep the property’s systems running smoothly. Cleaning, maintenance, servicing and landscaping ensures that your property remains in good shape and is protected for the coming years.

- Contact Center Posting/Information

-

All Residents of HUD Subsidized Properties (Click here for pdf printable version)

CGI provides Performance-Based Contract Administration (PBCA) services to the Tennessee Housing Development Agency (THDA) and is responsible for responding to resident concerns. The CGI Contact Center has a team of Customer Relation Specialists(CRS) who will receive, investigate and document questions and concerns you may have, such as, but not limited to the following:

- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose:

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serve as a neutral third party to residents, owners and the public.

- Assist with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours:

- Hours of Operation: Monday-Friday, 8:00am to 5:00pm (Central; 9:00am -6pm Eastern

- Contact Numbers: 888-384-3540 fax: 614-985-1502 (leave message after hours)

- Written Summaries: 107 South High Street, 2nd Floor, Columbus, Ohio 43215

- Email: PBCAContactCenter@cgifederal.com Website: www.TNPBCA.com

Concerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry:

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

CGI Federal

2630 Elm Hill Pike • Suite 115 • Nashville, TN • 37214

Contact center TTY: 800-848-0298 • Spanish TTY: 866-503-0263

Closing Thoughts-

If you are not already receiving this publication via e-mail, or if you have ideas, suggestions, or questions for future publications, we’d like to hear from you. Please send an email to andrew.hill@cgifederal.com